Steven Brill made headlines last week when he published a 26,000-word, 11-page Time article on why health care costs are so high–the longest article by a single author in the history of Time magazine. It’s a fascinating read, one that’s filled with real life stories, making it both more engaging and palatable than, say, a 26,000-word economics thesis on the same topic. But for those who don’t want to wade through all 11 pages, here’s a summary of Mr. Brill’s argument:

- Health care costs are so high in the US because prices for health care are so high.

- Prices for health care are high because by law, we have allowed them to be high. A lack of universal price controls allows “nonprofit” hospitals, pharmaceutical companies, and device makers to charge ridiculous prices and reap in huge profits.

- His solutions:

- Tighten anti-trust laws so that hospitals can’t conglomerate and demand high prices from “helpless” insurance companies.

- Tax hospital profits at 75% and institute a tax surcharge on non-doctor hospital salaries that exceed $750,000.

- Outlaw the “chargemaster”, an internal price list that all hospitals keep which contain ridiculously high prices that seemingly have no basis, and are often only used as a starting point in negotiations.

- Institute medical malpractice reform to reduce defensive medicine (doctors prescribing too much for fear of being sued).

The article has already generated a multitude of responses, especially from the health care blogger community–ranging from ardent support (from “crooksandliars.com“) to scathing criticism (from Mitt Romney’s domestic policy director).

I’m certainly no health care expert, policy wonk, or Carnegie Mellon professor of economics. But given what I’ve heard through working with hospitals across the U.S. (many of whom pay us precisely because they’re worried they’ll go out of business in a few years), I thought I’d throw in my own two cents.

(I’ve tried to be as objective as possible and use data to support my assertions when I can. But given my job, it’s certainly possible that I’ve been slowly influenced to adopt an overly sympathetic view of hospitals…in which case I better watch myself.)

Real Stories, Real Hardships

First, I think the the most important thing to keep in mind as we engage in debate about the economics of the health care system, and whether the various root problems and solutions that Mr. Brill identifies are real, is that the seven lives Mr. Brill outlines in his article are very real. Emilia Gilbert, the 66-year-old school-bus driver who was put on a payment schedule of $20 a week for six years from one fall and ER trip. Alice D., who decided she can’t remarry because she can’t “risk the liability” of being stuck with over $170,000 in bills for her husband’s end-of-life cancer treatment. These seven stories represent the 48.6 million Americans who are uninsured (a number that will hopefully continue to drop as insurance expansion rolls out next year), people who are very much vulnerable to the excessive hospital prices that Mr. Brill outlines.

Brill’s Demonized Chargemaster is a Distraction

However, from a system perspective, I think the chargemaster that Mr. Brill repeatedly attacks is a distraction. The chargemaster is the internal list of prices that every hospital keeps for every procedure and supply item that the hospital uses. These are the prices that Mr. Brill incredulously highlights: $1200 for one hour of a nurse’s services; $1.50 for a single Tylenol tablet that you can buy a 100 of for $1.49 on Amazon.

They are indeed ridiculous, and often created without rhyme or reason. Thing is, they’re also rarely used:

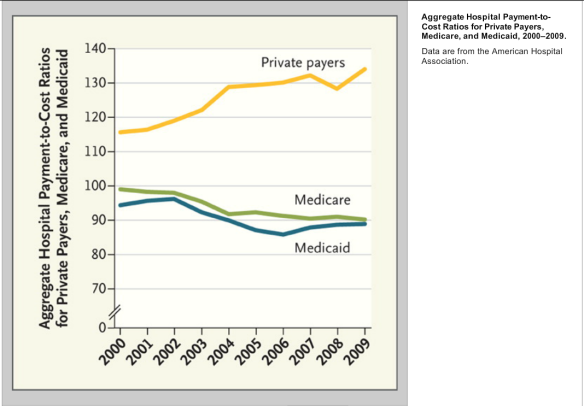

- The latest data (from 2009) shows that on average, 40.9% of hospital cases in the U.S. are paid for by Medicare. Medicare, which–as Mr. Brill describes–could give a rat’s *** (my words) about chargemaster prices and instead pays each hospital a set amount, about 90% of the actual costs of treating that patient (see graph below).

- Another 17.2% are paid for by Medicaid, which vary on a state-by-state basis but are usually some percentage off of Medicare rates.

- 30.5% are paid for by HMOs, PPOs, or other private insurance. According to Mr. Brill, these private payers negotiate rates that are 30-50% higher than Medicare rates (rather than negotiating downward from chargemaster rates).

Here’s a handy graph showing how payments from Medicare, Medicaid, and commercial payers compare to the cost of treating a patient. Note that Medicare and Medicaid actually pay less than costs on average while commercial payers pay more–leading to the phenomenon of hospitals using profits from commercial payers to “cross subsidize” the costs of treating public payer patients. Source: Ginsburg PB. 2011. Reforming provider payment – The price side of the equation. N Engl J Med, 365:1268-1270.

- Excluding workers comp and some other miscellaneous categories, this leaves “just” 4.9% that are true self-pay cases, where the uninsured is charged the full chargemaster price. HOWEVER, many hospitals offer payment subsidies, discount prices, or simply write off patients’ charges as uncollected “bad debt”. A 2008 analysis of actual payments received by hospitals in California showed that the median uninsured patient paid 1% less than Medicare rates and 28% less than commercial rates.

These numbers suggest that the individual stories Mr. Brill documents may be limited to a very small subset of the population. Indeed, the average self-pay payment rate rate was higher than the median (20% higher than Medicare and 14% less than commercial), indicating a rightward skew–a small number of uninsured patients are truly getting hit hard. However, the concern about these ridiculous prices, and the dangers that a subset of the uninsured face when they can’t get discounts, can be solved by a simple solution–one that doesn’t require outlawing the chargemaster as Mr. Brill recommends, which would arguably make hospital prices even less transparent (the “Treatment for Heart Attack: $100,000” bill, as Oren Cass posits). Rather, it’s a solution that Uwe Reinhardt suggested back in 2009: a national ceiling of 115% of Medicare rates for charges to the uninsured. Since hospitals are only collecting de facto payments of 1% less than Medicare rates from the median uninsured patient anyway, it’s not like it’s going to affect their bottom line. They would get to keep their (admittedly meaningless) chargemasters for negotiating purposes, patients could still see everything they’re being charged for (without having to pay the full amount), and those uninsured patients that are getting hit with true full prices today would be protected.

Are Hospitals Really That Profitable?

Apart from the chargemaster, Mr. Brill sees the primary culprit behind high health care costs as paradoxically profitable “nonprofit” hospitals that command high prices from “helpless” insurance companies and manipulate their “sympathetic nonprofit status” to reap in huge profits and dissuade lawmakers from doing anything about it. “That’s a 12.7% operating profit margin,” Mr. Brill writes of Stamford Hospital’s 2011 financials, “which would be the envy of shareholders of high-service business across other sectors of the economy.”

But is that really true? As of January 2013, the average operating margin of 6177 U.S. firms across most major sectors was 17.1%. The average for Medical Services was 10.1%–hardly enviable from a market perspective. In addition, as Mr. Brill himself notes, hospital inpatient care has an operating margin of only 2%. (Which does beg the question, why is hospital outpatient care so “wildly profitable”–and is this something that should be addressed? Perhaps more on this in a later post.)

I’m also somewhat dubious that the insurance companies Mr. Brill mentions are anything but helpless. Mr. Brill is right when he points out that hospital consolidation will increase their negotiating power against insurance companies. What he overlooks is the fact that insurance companies are consolidating too. Last July, WellPoint announced that it was buying Amerigroup. Six weeks later, Aetna announced it was buying Coventry. Which consolidation will “win out” on prices–hospitals or insurers–is unclear, but this 2011 study is enlightening: while consolidation of hospitals does appear to drive up prices, consolidation of insurers appears to have the opposite effect of driving down prices (by about 12% in the most consolidated markets), and that overall, “more concentrated health plan markets can counteract the price-increasing effects of concentrated hospital markets.”

On balance, excessively profitable hospitals may not be the major cause of excessive costs, as Mr. Brill believes. In fact, signs suggest that hospital profits are about to drop. Plans for the exchanges, which roll out next year, will likely pay hospitals lower than current commercial rates (10% lower, according to recent news from Texas; most providers fear more). Payment penalties and reforms from the Affordable Care Act, combined with movement by commercial payers toward paying for value, will only serve to further push down prices.

Barking Up the Wrong Tree

In 26,000 words, Steven Brill has painted a picture of soaring health care costs because profitable hospitals command high prices. Interestingly, Mr. Brill stops short of actually advocating for any type of price controls. The logical solutions–as Matthew Yglesias at Slate points out–would be to either (1) expand the price-setting Medicare program to cover the entire population, or (2) set health care prices nationally, as a number of European countries do. Aside from the fact that both solutions would be politically DOA, each one would either face substantial challenges or have unintended consequences.

However, given that full hospital prices only apply to less than 5% of cases, and that hospitals may not be as profitable as Mr. Brill suggests, trying to control hospital prices as a way to control health care costs may be barking up the wrong tree.

As Mitt Romney’s Domestic Policy Director points out (and as much as I hate to agree with Mitt’s anyone on anything), the true question may not be why health care prices are so high, but why the costs of providing that care are so high. As he writes:

“All of those enormous costs for treating a patient actually go to pay for things, not to line the pockets of scheming industrialists. But what? How much of a hospital’s expenditures are construction? Capital equipment? Doctors? Supplies? Management? Bureaucracy? And each of those things that it buys – an MRI machine, a pacemaker, a cancer injection – where does that money end up? How much of it goes to researchers? To the acquisition of start-ups that create new intellectual property? To TV advertisements? How much of a doctor’s income goes to the cost of her education? To her malpractice insurance?”

One more thing I would add: How much of the money we pour into health care is for services we don’t need? How much is going toward outcomes we don’t value? And most importantly, how can we get our health care system to start achieving ones that we do?

Pingback: Health Wonk Review for March 14, 2013

Pingback: Price Transparency: An Interactive Timeline | In Sight

When was the last time you could hope to have a 10% return on your investment? Brill never said a huge number of people paid the chargemaster prices; he questioned the reason for them. High prices and a Rube Goldberg pricing system have been allowed to grow until it’s like the tax code. Profits go to hospitals, equipment makers and insurance companies, who have no incentive to change. As Brill points out so clearly, we do not have much of a choice: when I was in a catastrophic car accident, my husband didn’t stop to price shop. For those free marketers out there, how about letting all involved to fully negotiate prices?

it really is the charge master, I am posting a detailed explanation tomorrow am at http://insureblog.blogspot.com/. The high charge master is the threat that allows so many other problems.

Pingback: ah, but it really is the ChargeMaster….. | AtWola

This is not meant to excuse the hospiitals who beat up on a few uninsureds, but as you say, the problem is not profits.

Any institution which has expensive facilities and relatively few “customers” will have “high prices” if they are privatized.

An urban fire department which has a million dollar budget might only fight 100 fires in a quiet month.

So if the fire department was privatized, it would have to charge $10,000 per fire.

We would see “water usage” billed at $800 for water that is basically free from the city pipes.

We would see bills for $350 for “counseling” when none was done.

In addition, some households would not pay the $10,000 — hey, they just got wiped out in a fire! —

so the households which did have good insurance would be billed extra.

These last few ugly incidents do not happen, because we pay for the fire department in taxes and it has an annual budget.

And that is how we should be paying for hospitals!

Not tomorrow, but that should be the goal. Facility based funding.

Bob Hertz

The Health Care Crusade

Pingback: My Post Featured in Health Wonk Review! | In Sight

Pingback: Health Wonk Review: A lot to chew on — US Health Crisis

Pingback: Health Wonk Review: A lot to chew on » Health Business Blog

Must be a lot of fear over Mr Brills article, for the rebuttals to be out so quickly. Quite transparent on your part.